Retail financing is appealing to consumers and merchants alike. Consumers can make purchases without paying the total cost upfront, while merchants benefit from the simple fact that they’re generating more sales. Merchants that offer retail financing, and more specifically a waterfall lending option, at the point of sale are likely to see more loan approvals, higher sales, and happier customers.

To learn more about retail financing and the value that waterfall lending offers to retailers and consumers alike, PaymentJournal sat down with Mitch Ferro, CEO of Mastercard Vyze and Brian Riley, Director of Credit Advisory Service at Mercator Advisory Group.

What is retail financing?

At its core, retail financing is when retailers offer customers alternative lines of credit to make purchases that they can’t, or prefer not to, pay for upfront with cash or an existing line of credit (such as a credit card). There are a variety of retail financing products that make sense in a variety of situations. For example, installment loans, which have traditionally been used for more expensive purchases, today are being used for smaller ticket items as well.

Historically, consumers have relied on their traditional lines of credit to make purchases then pay the bill at a later date. In times of economic uncertainty and distress, however, consumers tend to preserve their lines of credit; this was apparent upon the onslaught of COVID-19, when credit card purchase volumes quickly fell. Similarly, lenders have tightened their lines of credit and portfolios in the interest of risk management.

At the same time, consumers still need to have the ability to make such purchases which is where retail financing comes in. Retail financing allows a consumer to make a purchase with alternative lines of credit which exist outside of traditional credit cards. “That’s a good option [to preserve a line of credit] as you look toward the uncertainty we have in the economy,” noted Riley.

Retail financing is in high demand

Consumer demand for retail financing is growing. In fact, McKinsey estimated that consumer demand for retail financing is $1.1 trillion annually and represents 3.5% of consumer spending. This can be attributed to the reason noted by Riley: households, especially those struggling amid the pandemic, want to effectively manage their budgets and preserve their credit lines.

McKinsey also estimated that installment financing will grow by 18% to 22% by 2022, which Ferro explained is five times stronger than the growth of general purpose credit cards. This significant growth has caught the eye of merchants, who are expressing “a real interest in offering [installment loans] to their consumers because they want to remain competitive and provide consumers with what they are looking for,” said Ferro.

Alternative financing means more sales for retailers….

According to Ferro, the baseline reason merchants are considering retail financing is simple: they want to sell more. “They want to have more consumers walking out of their shops, whether that’s a physical brick and mortar shop or a virtual one, with the goods they’re looking for,” Ferro explained. Retail financing is one way to make that possible.

Retail financing options are available to a wider spectrum of consumers where a waterfall platform is used. Those not served by traditional lenders, such as consumers with low FICO scores and those new to credit, the workforce, or the country, can benefit from this type of financing platform.

“The other piece that we see from a merchant’s perspective is that they want to preserve their brand and relationship with the customer,” added Ferro. The improved experience that comes with white label financing drives that loyalty and fosters positive brand relationships with satisfied customers.

… While providing improved buying experiences for consumers

Consumers want confidence, convenience and control when the shop. They want to increase their purchasing power, they want to be approved at checkout and they want the process to be easy.

For example, a consumer that needs a new refrigerator but doesn’t want to impact their credit score can turn toward retail financing as a way to take control of their budget.

When a customer gets approved for financing at a merchant, they are more likely to use that same merchant for future financing needs, creating a win-win situation that Riley described as beneficial for both the merchant and consumer.

Waterfall lending: A valuable approach to retail financing

Waterfall lending is the concept of enabling a merchant to use a network of lenders to deliver financing to consumers, rather than relying on a single lender. It is referred to as a waterfall because the loan application cascades behind the scenes from one lender to another to identify the best-fit option for a given consumer.

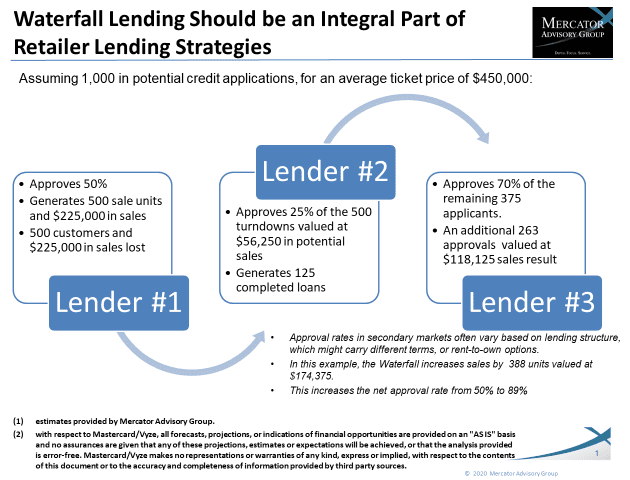

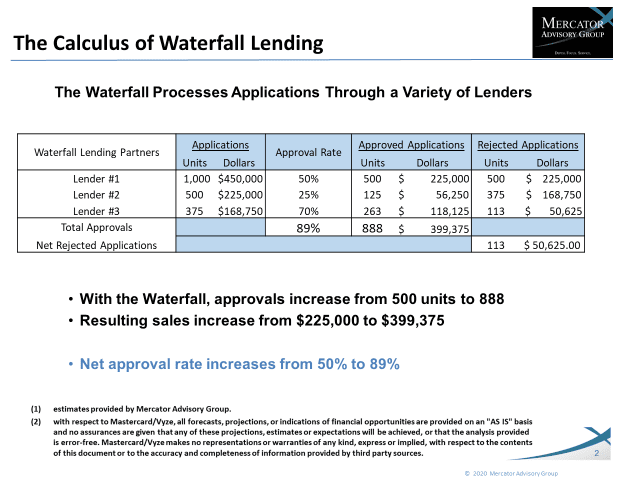

Because there are a group of lenders rather than a singular solution, waterfall lending results in higher acceptance and approval rates across a more diverse segment of customers. The following chart, provided by Mercator Advisory Group, illustrates this concept:

In this example, Lender #1 approves 50% of 1,000 transactions. The 500 remaining declined transactions flow to the second lender, which approves 25% (or 125) of them. Finally, the 375 remaining applicants trickle down to Lender #3, which approves 70% (or 263) of them. Ultimately, the waterfall increased approvals from 50% to 89% (or 500 to 888 transactions). Because each transaction is attached to a ticket price, the merchant’s revenue increases.

This process happens within an instant. “They (consumers) simply know within seconds of their application that they’ve been approved for financing and what the terms and conditions are.” “The approach is about making it easy for the consumer,” said Ferro.

Merchants looking to offer waterfall lending are turning to platforms like Mastercard Vyze. The platform’s network of lenders means they can offer their customers greater purchasing power and a frictionless checkout experience. “This type of solution has multiple winners. It’s really a win-win-win type of solution for all participants,” said Ferro.

The takeaway

Merchants that offer retail financing, and more specifically a waterfall lending option, at the point of sale are likely to see more loan approvals, higher sales, and happier customers.

Click here to register for the upcoming webinar, How Merchants Can Increase Their Bottom-line With Waterfall Lending.