At PayPal, we’re building solutions for global commerce to help our millions of global consumers and businesses seamlessly connect across all contexts. As part of this mission, we recently launched PayPal Checkout with Smart Payment Buttons™ in the U.S. to give consumers more choice in how they can pay and is designed to help drive conversions for businesses. Today, we’re beginning to roll out PayPal Checkout with Smart Payment Buttons globally. In addition, after launching PayPal Marketing Solutions in the U.S. late last year, we’re beginning to roll it out to additional markets to help businesses better understand their customers and drive sales.

PayPal Checkout reduces the number of clicks or taps along the path to purchase, and has been shown to drive the highest conversion rates across the industry. A recent comScore study found that PayPal Checkout converted at 88.7 percent during checkout — 82 percent higher than a checkout without PayPal.

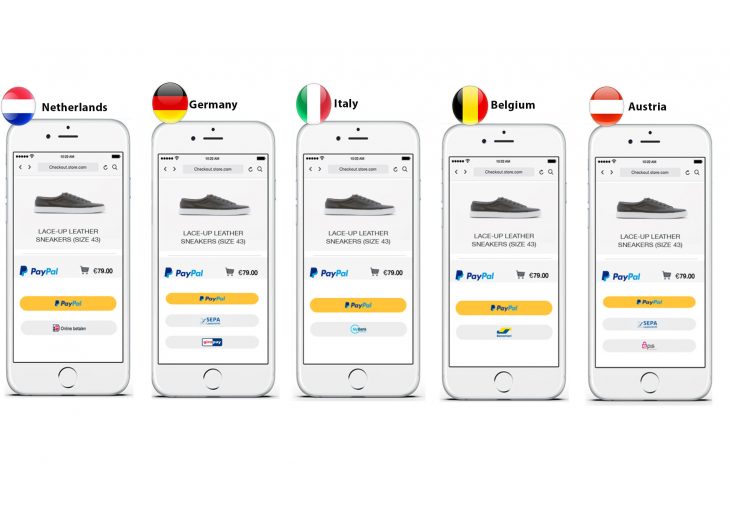

With one simple integration, PayPal Checkout with Smart Payment Buttons enables a personalized checkout experience and dynamically presents the most relevant payment methods at checkout. This includes PayPal, Venmo, PayPal Credit and now, we’re starting to roll out local alternative payment methods including iDEAL for customers in the Netherlands, Bancontact for customers in Belgium, MyBank for customers in Italy, Giropay for customers in Germany and EPS for customers in Austria. In addition, we have long enabled SEPA Direct Debit for customers in Germany. Businesses selling across borders to customers in the above markets will be able to dynamically present relevant local wallets based on the customer’s location. We expect to roll out additional local payment methods in the near future.

PayPal Checkout includes powerful conversion drivers like One Touch, which enables consumers to check out across millions of businesses without having to enter usernames, passwords, or payment information, once they’ve opted-in. Through One Touch Acquisition, another feature of PayPal Checkout, shoppers can create accounts and set up payments with a business without having to type in all of their information, which is designed to help increase registration, conversion and repeat purchases.

Businesses that have integrated with PayPal Checkout can also enable PayPal Marketing Solutions, to better understand their customers and help drive sales. Smart Incentives, a feature of PayPal Marketing Solutions, enables businesses to engage with PayPal’s 250 million global active customer accounts at the beginning of their shopping journey. With Smart Incentives, businesses can let consumers know at the point of entering a site that they can skip logging in at businesses that have One Touch enabled, get financing for their purchases with PayPal Credit,*** get return shipping costs refunded on eligible purchases with Return Shipping on Us and get purchase protection with PayPal Purchase Protection. Shopper Insights, another feature of PayPal Marketing Solutions, gives businesses aggregated and anonymous insights into PayPal shoppers visiting their site so that they can see where their opportunities are. PayPal Marketing Solutions is live in the U.S. and is now beginning to roll out to additional global markets.

Businesses around the world like Beyond Proper by Boston Proper, Guess?, Inc., and Zumiez are already using the new PayPal Checkout with Smart Payment Buttons to offer their customers more choice and to drive conversions. Ecommerce platforms from Magento to WooCommerce have already enabled the new checkout experience for their customers.

As always, PayPal Checkout includes features like Purchase Protection and Seller Protection on eligible purchases, the ability to sell across contexts — like within social media feeds — as well as across borders, and enables customers to complete a purchase directly on a business’s website.

Until now, only the very largest ecommerce companies had access to tools like this, but as part of our mission to democratize access to powerful commerce tools, we’re now enabling this for businesses of all sizes around the world. We are constantly working to build the tools that will help businesses of all sizes enable better experiences for their customers so they can more effectively compete, in turn, fostering a vibrant and thriving retail ecosystem. Learn more about PayPal Checkout and PayPal Marketing Solutions and get started here.