The numbers are staggering: $800 billion to $2 trillion is laundered every year by the global financial industry. An equally troubling figure: Less than 1 percent of global illicit financial flows are seized or frozen, despite the aggressive financial surveillance and anti-money laundering (AML) regimes enacted in the wake of 9/11. [1]

U.S. financial institutions are desperate to combat money launderers — and to avoid being unwitting financiers for terrorist networks, drug cartels and other criminal groups that threaten national security. But the U.S. AML regime is up against shifting sanctions guidance, cyber-enabled crime and new data-reporting demands that make a tough role even more challenging.

To better understand how U.S. financial institutions are responding to this evolving-threat landscape, Thomson Reuters recently surveyed 438 AML compliance leaders connected with the Association of Certified Anti-Money Laundering Specialists (ACAMS). Their insights are captured in the 2017 Thomson Reuters U.S. Anti-Money Laundering Insights Report, which aims to provide a data-driven framework for AML professionals to use in making better operational and budgetary decisions.

Shifting AML Policies and Regulations

The big takeaway: It’s a balancing act. AML professionals are charged with properly identifying suspicious activity, but they must do so in a way that also allows for the kind of customer experience that the vast majority of law-abiding account holders deserve.

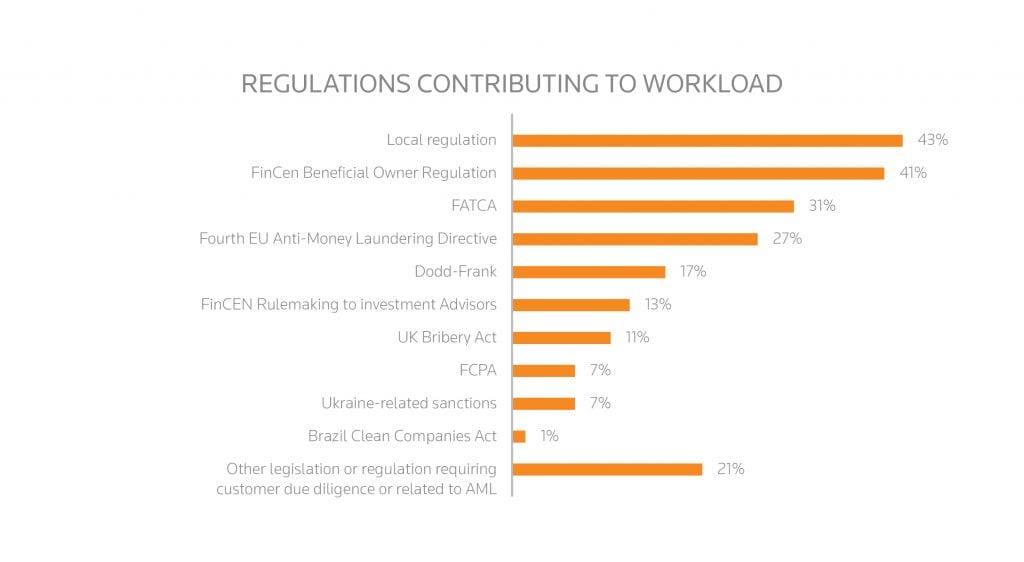

Beyond this balancing act, AML professionals are contending with continual shifts in AML policies and regulations. In the past year, financial institutions have had to overhaul their customer screening, monitoring and reporting processes to comply with the changing priorities of the U.S. Treasury’s Office of Foreign Assets Control (OFAC). For example, financial institutions have had to adjust to the Obama administration’s easing of sanctions against Iran, Cuba, Burma and Sudan, as well as to new penalties against Russia for its alleged meddling in the 2016 election.

In addition to shifting OFAC priorities and sanctions guidance, confusion is anticipated following the Trump administration signaling plans to relax enforcement of Foreign Corrupt Practices Act (FCPA) laws.

On top of all this uncertainty are new rules from the Financial Crimes Enforcement Network (FinCEN), which will go into effect in 2018. Astonishingly, only 62 percent of AML professionals are confident their organization can comply with this more onerous regulatory framework for verifying customers and the ultimate beneficial owners (UBOs) of legal entity accounts. This is troubling, as almost 40 percent of respondents indicated they may not be prepared to comply with regulations that will be enacted in less than a year.

AML Risk Management

AML Risk Management

Respondents’ handling of UBO data is equally concerning. While it’s common knowledge that money launderers attempt to hide their identity when engaging the legitimate financial market, an unbelievable 89 percent of organizations still verify the UBO information directly from the customer. As self-reported customer profiles cannot be taken at face value, independent verification is vital to AML risk management. A related and equally alarming trend is that 58 percent of respondents cited the inability to verify UBO data as their greatest operating challenge.

In short, AML professionals must be armed with technology as formidable as the criminals they are trying to stop. Though overwhelmed, they are of course working to make sure their organizations are in compliance and managing their business and operational risk well.

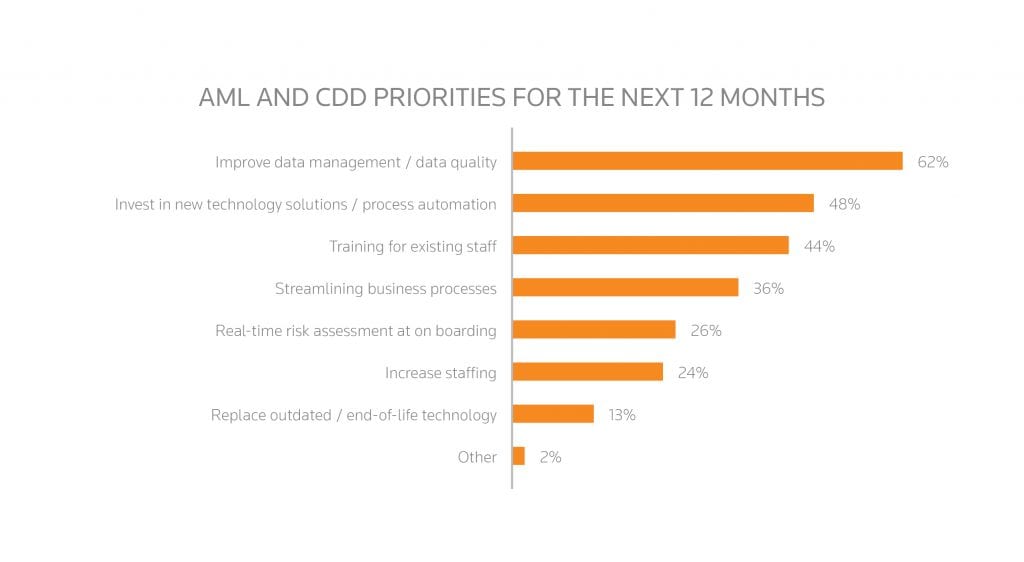

This emphasis on compliance and managing risk is reflected in how respondents ranked their focus areas for the coming year. Respondents indicated that their top priorities are to improve data management and quality (62%), invest in new technology solutions and automation (48%) and train existing staff (44%).

U.S. financial institutions are in the eye of the AML storm, and the report findings may be the wake-up call the industry needs. With new rules and regulations looming large, AML professionals must engage the right solutions to control compliance costs, allocate resources more efficiently and deliver the operational transparency needed to drive growth.

U.S. financial institutions are in the eye of the AML storm, and the report findings may be the wake-up call the industry needs. With new rules and regulations looming large, AML professionals must engage the right solutions to control compliance costs, allocate resources more efficiently and deliver the operational transparency needed to drive growth.

About the author

Mark Haddad is head of the Corporate Segment, which provides solutions and services to meet the needs of in-house law departments as well as corporate risk and compliance professionals, at Thomson Reuters Legal.

[1] https://www.unodc.org/unodc/en/frontpage/2011/October/illicit-money_-how-much-is-out-there.html